The big question on every investor’s mind is, will there be a market correction in real estate? Of course, this is a complicated question that demands a complicated answer, as there are several drivers working for and against the current market.

To help you to understand some of the mechanics, we have given a summary below on real estate cycles, debt cycles and our view of how these two cycles are currently working together.

What drives real estate cycles?

One of the wonderful aspects of real estate as an asset is that its utility is tied to a specific location. Both supply and demand for real estate are tied to a specific geographic radius. You may have heard the statement that “real estate is hyperlocal” which is to say there is not one big real estate market, but rather many small independent markets. Each of these markets can be at a different phase of the real estate cycle at different times, which means that at any given moment there are markets that are experiencing growth, where investors are making money entirely independent of any larger economic conditions.

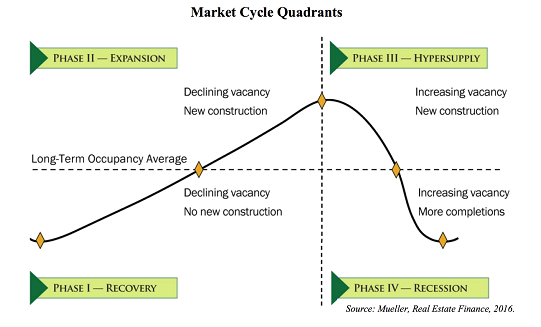

Let’s take a moment to understand the real estate cycle. (See figure 1 below):

Like anything else, the value of real estate is driven by Supply and Demand. In Phase 1 (recovery) we have rising demand, stagnant supply, and declining vacancy. Asset values rise steadily through Phase 1.

In Phase 2 (expansion) occupancy rises above the long-term average, and the market begins to exhibit signs of being undersupplied. Vacancy continues to decline; rents and asset values will rise steadily. The rising rents and asset values make it worth the risk for developers to justify building new real estate.

Transition from Phase 2 to Phase 3 (hyper supply) is typically very subtle at first. The shift to oversupply is first characterized by increasing vacancy, as the number of new units delivered to the market begins to outpace the unit absorption. As occupancy decreases toward the long-term average you begin to see rents decrease as property owners look to increase occupancy by offering more competitive rents or concessions. This is accompanied by a decrease in asset values as lower rent equates to a lower net operating income (NOI).

The transition from Phase 3 (hyper supply) to Phase 4 (recession) is characterized by a sharp decline in new construction starts. Vacancy continues to increase, and occupancy falls below the long-term average as units from projects already in progress continue to be delivered to the market. To get these newly delivered units occupied, owners typically have to offer very competitive rents and heavy concessions. It becomes a renter’s market, as all properties in the market compete to try to push up occupancy.

Looking closely at the horizontal axis of figure 1, which represents time, you can observe an interesting characteristic of the real estate cycle, which is that the downward half of the cycle takes half the amount of time as the growth half of the cycle.

This is because it takes much longer to build and deliver new units (supply) to a market than it does for population growth and inbound migration to increase (demand) in a market. Then, as the recession phase of the market is characterized by lower rents, and lower asset prices, the relative affordability of housing in the market will start to attract more tenants, and lower pricing in the market will start to drive higher investor demand which will rapidly push Phase 4 (recession) back into Phase1 (recovery).

So, what stage of the cycle are we in now?

It is a very interesting time to be a real estate investor. Many markets continue to exhibit strong fundamentals and all indications are that some of these markets are still in the expansion phase (Phase 2) of the real estate cycle. So, let’s double down, right?!

Well, not quite.

Real estate investing is very much influenced by debt cycles.

One of the hallmark benefits of real estate investing is the ability to leverage the investment and make money by investing not only your money, but also the bank’s money. However, this leverage is only beneficial when the property generates more cashflow than the cost to service (or pay back) the debt.

It is also important to understand that with regards to real estate, the availability and cost of debt provides buyers with purchasing power. When debt is plentiful and cheap, many buyers have purchasing power, and this equates to an increased demand for real estate.

So, we need to understand how capital is flowing today and how a shifting debt cycle can affect real estate values.

What drive supply and demand for debt?

In a completely free economy, the forces that drive the debt cycle are the supply of capital available for lending, and the demand of borrowers willing to take on debt. In a free economy the supply of capital is finite, and the supply of lendable capital is determined by the amount of outstanding loans relative to the total capital pool.

The cost of this capital fluctuates with demand and risk level. The risk of a loan at any given time is determined by the value of the asset securing that loan and the amount of the loan as a percentage of the asset’s value (known as Loan-to-Value, or LTV).

The other factor that determines “risk” is the borrower’s ability to pay back the loan. The more money the borrower makes above and beyond the cost of the debt service, the lower the risk that the borrower will default on that loan.

Understanding debt cycles

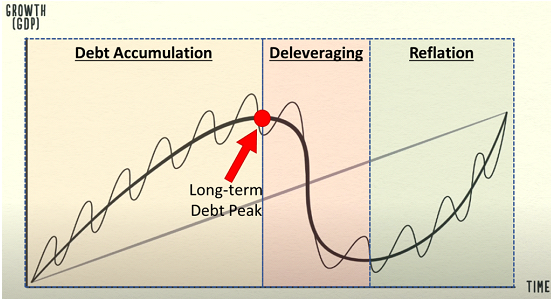

The chart below depicts both the short term (thin grey line) and long-term debt (bold line) cycles.

With the goal of facilitating long term growth in the economy, debt will be accumulated until such point that asset values or incomes of the borrower no longer support the debt. At this point, the principal of the loan must be reduced, or the income of the borrower needs to increase, until the level of debt can once again be supported by the borrower. This short-term cycle of leveraging and deleveraging will continue indefinitely over time, as represented by the thinner gray line oscillating up and down around the dark gray line in Figure 2.

Since debt is facilitating growth and production in the economy, the presence of this debt also increases income and asset values in the future, which in turn supports more debt over time. This creates the ‘Debt Accumulation’ phase of a longer-term debt cycle. The opposite is also true – a sustained contraction of debt in the short term leads to slower growth and production, which in turn lowers income and asset values in the economy, leading to more ‘Deleveraging’ over time.

Of course, we do not operate in a completely free economy. The factors that drive the cost of debt, and the debt cycle are more dynamic and often political in nature. However, from a real estate investing point of view, it is best to view the availability of debt as simply purchasing power or a contributing factor to demand.

And where are we now in the debt cycle?

We have been through a period of high capital flows. Governments have printed a significant amount of money and that money has been flowing freely through the capital markets. Debt has been plentiful over the last year and a half. However, to combat inflation, the Fed is now actively and aggressively reducing money supply and increasing interest rates and we are very much now in a de-leveraging phase of the debt cycle.

This has a number of implications that will affect real estate and the investment environment.

So, let’s bring it all together

As we mentioned earlier, many real estate markets appear to still be in an expansionary phase of the real estate cycle. So how might the current phase of the debt cycle affect this?

To begin with, the increased debt service cost clearly lowers investor’s purchasing power, which should act to slow down demand for real estate.

However, it may not be so clear-cut. Increasing interest rates lower the purchasing power of retail consumers, which further increases the barrier to home ownership. This will force some would-be homeowners to remain as renters, which in turn will increase demand for rental housing and continue to drive the expansion phase of the real estate cycle.

The purchasing power of developers will also be affected. Developers tend to deliver new supply of housing and balance the demand pressure in a market. If developers slow down their activity due to a more difficult debt environment, this can serve to keep demand for real estate high and further drive the expansionary phase.

In general, there appears to be plenty of scope for rental demand to remain high and for this to continue to drive asset price appreciation in the real estate market.

However, recall in our discussion of debt cycles, that debt is only sustainable as long as the borrower’s income can continue to support the cost of debt. When the cost of debt increases, we therefore need a sufficient increase in income for the numbers to continue to work.

Yes, we saw rents rise more than 30% in some markets in 2021 and yes, we continue to see strong rental demand in many markets, which might suggest that there is further rental growth to be expected in 2022 and beyond. As long as rents remain affordable in these markets.

And perhaps that is one of the most important factors. In strong markets, where rental demand remains high and where affordability for these rental rates continues to exist (i.e., the income is there to support higher rents), we can expect continued growth in NOI that will be sufficient to cover any increased cost of debt, and this should serve to maintain demand for this type of real estate and continue to drive pricing for these assets.

However, in weaker markets we may start to see a temporary price correction as we wait for the NOI on these properties to catch up to the increased cost of debt service. The weaker the market, the longer the deleveraging period, as asset values fall until the point where NOI can start to support the debt.

And the longer-term outlook?

The fundamentals of many real estate markets certainly show that there is significant runway left in the expansion phase of the cycle. However, higher cost of debt service and lower leverage will start to erode investor cashflow.

It is important to put this into context by remembering that the deleveraging part of the debt cycle slows all growth and productivity across the economy, and because of this when compared to other investment alternatives, real estate still represents a good investment option, even with slightly lower cashflow.

The question becomes: “Will this growth outpace the erosion of purchasing power of the future investor that you will sell you property to?”

This is the hardest part of real estate investing as we do not know what the future holds and cannot predict future investor demand. However, it is important to remember that value, especially in real estate, is relative.

The value of an investable asset should always be assessed relative to its’ inherent risk level. High quality and less risky assets will always be in demand in times of higher uncertainty, as investors seek to reduce risk in their investments wherever they can.

In this unique landscape I think it is best to invest in the highest quality assets in the best quality markets, as these investments will always have relative value now and in the future.