In March the Fed increased interest rates for the first time since 2018. The Fed indicated that they are expecting to increase rates a further 6 times in 2022 and the bond market seems to be pricing in these increases.

But how much certainty is there in all of these projections?

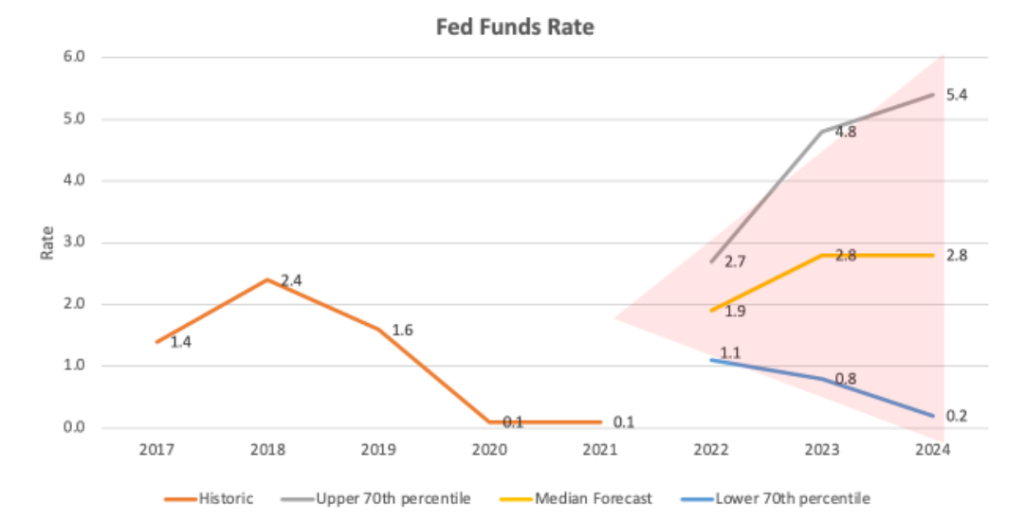

If we look at the range of projected outcomes that the Fed is publishing, we can see that the funnel of uncertainty is actually really large. By the end of 2022, the range that gives a 70% confidence interval is for the fed funds rate to be between 1.1% and 2.7%.

While the bottom end of that range still represents a couple more rate increases to come this year, it would represent a vastly different outcome than if the fed funds rate were to be 2.7% by year end.

If we look out to 2024, we can see an even bigger range of uncertainty! The range that gives a 70% confidence interval stretches from 0.2% to 5.4%!

What does history teach us about these projections?

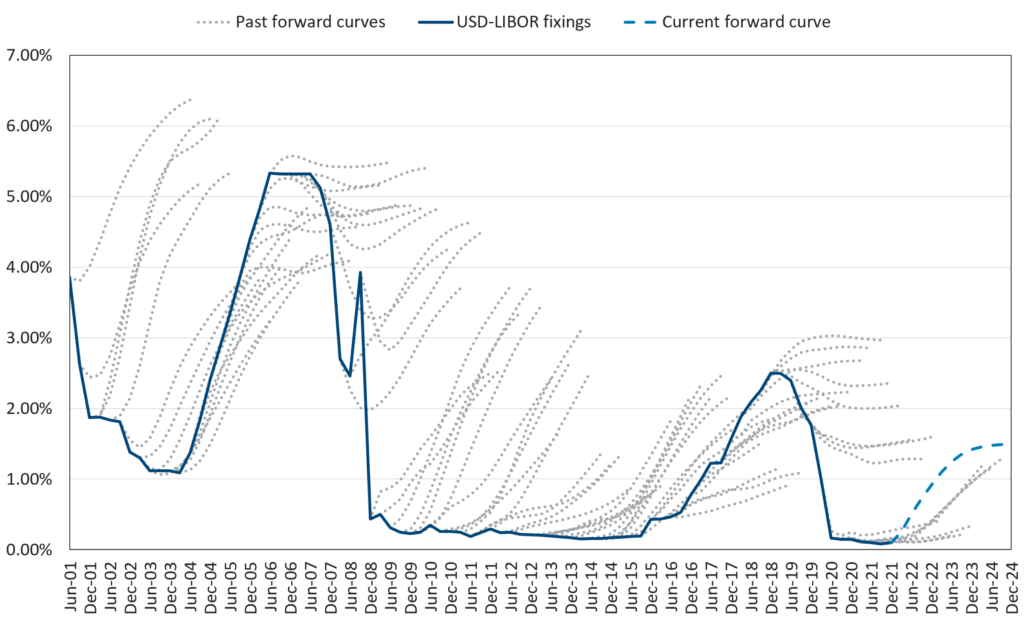

It’s interesting to look back in time to see how accurate historic projections have actually been. The chart below from Chatham Financial shows the 1-month USD LIBOR rate over time in the solid line and then the “hairy lines” are historic forward curve projections at various points in time.

1-month USD LIBOR vs. historical forward curves

We can see that usually the forward curves have been wrong. While oftentimes the direction of the forward curves may have been correct, the exact timing of rate changes (or lack of rate changes) have been vastly different.

So how do we interpret all of this and apply to Multifamily investing?

Although there is no way to tell how far or how fast the Fed will increase interest rates, we do know with a very high level of certainty that rates will continue to increase in the short term and that increased rates will result in lower leverage and decreased cashflow for multifamily acquisitions.

In times of uncertainty, it is best to remove as much risk as possible, by controlling the variables that we can. Fixed rate debt is obviously the best hedge against rising interest rates, but fixed rate lenders have widened spreads considerably in the last few months, so fixed rate debt may not work for every deal.

There are a few tools at our disposal for both fixed and floating rate debt that can help further mitigate the risk of rising interest rates.

- Index Lock agreement– Entering into an index lock agreement with a lender which locks in the index as of the date of the agreement, instead of the closing date of the loan.

- Interest Rate Cap– An interest rate cap can be purchased by a third party three days prior to closing and will cap the amount that a variable rate interest rate can increase over a given term.

- Maximum Rate agreement– A maximum rate agreement is like an interest rate cap however this is built into the loan agreement and provided directly by the lender.

Multifamily Investing is still one of the lower risk, stable cash flowing investment options available to investors today. However, it is important to keep a keen eye on the Federal reserve’s interest rate moves, and to understand how they impact project cashflows. Be sure to use suitably conservative assumptions about the future debt service cost.