Recent data from Indeed on job postings reinforces the notion that the economy is contracting quite rapidly. Less available jobs mean less paychecks, which means less spending, which means economic contraction.

And this will reinforce itself until something stimulates growth.

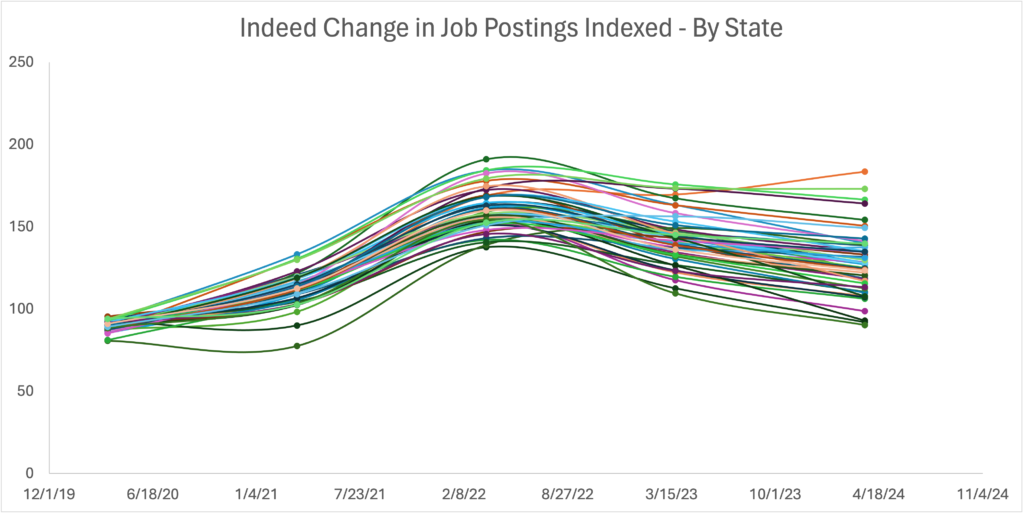

The Indeed Change in Job Postings Indexed, shows the rate of change of job postings year-over-year and month-over-month. As the graph below shows, almost all States have experienced reductions in job postings for the last two years.

Data in 2024 shows that all States have reduced in the last year, except for Alaska and Mississippi.

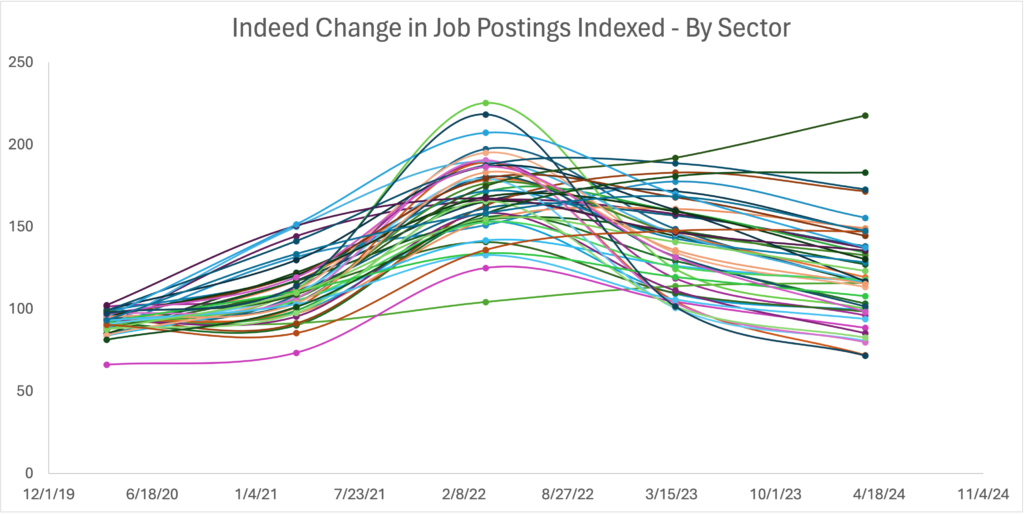

When we look at data by Sector, we see largely the same result, although there are some notable sectors where job postings have been growing – Physicians & Surgeons, Beauty & Wellness and Therapy.

It is also interesting to note a few sectors that grew fastest following Covid, that have now taken a sharp fall since 2022 – Human Resources, Software Development and Production & Manufacturing.

So what does this mean for multifamiy?

If we take this data and combine it with the fact that unemployment has started to increase as well, we expect less afforability generally, which in turn would lead to more vacancy, softer rent growth and potentially higher bad debt – such recessionary factors will affect the operational performance of real estate.

Of course, these are generalizations, and every market, sub-market and asset will have its own factors that influence the extent of any impact.

If we start to see these types of trends cross the industry, it may exacerbate any current issues that owners have with regard to high interest rates and this may lead to some loan workouts turning into debt sales.

What are we doing to mitigate potential risk from this indicator?

From an asset management perspective, we are always monitoring for recessionary factors proactively. By tracking occupancy, lease trade outs and delinquency weekly, we stay on top of any trends before they become an issue.

In this environment, it often makes sense to focus more on maintaining higher occupancy, rather than seeking rent growth.

We also ensure that onsite staff are providing the best possible customer service to existing residents, encouraging them to stay through positive experiences and interactions, so that we avoid having to fight lower occupancy and fight for new residents through concessions or lower rents.

From an underwriting perspective, we are even more selective on markets where we would like to invest in the near term. We are also very careful with the assumptions that we are making in the short term, with respect to economic vacancy and rent growth.

It is critical that the right debt structure is selected for any new investment. Healthy leverage allows you to weather the storm in the short term and we always ensure that the term of debt matches the term of the business plan.

It will be an interesting 2024, as we wait to see how inflation progresses, whether the Fed takes action, how the election will play out and how the economy will fare.

For us, we will continue to focus on operating our properties as efficiently as possible, no matter the environment, and we will continue to focus on the core fundamentals when looking for new opportunities – sensible leverage, and strong risk-adjusted returns for investors.

To learn more about how we can help you to generate superior investment results through professionally managed Real Estate investments, click here to register for our investor club.