More rate cuts, Quantitative easing, and maybe even stimulus checks

After the fastest pace of interest rate hikes in U.S. history, we finally got our first rate cut in September. The 50bps point cut represented a distinct pivot from the Fed’s previously hawkish and resilient position. Many critics of the move pointed out that Inflation had not receded, and the aggressive cut could spark a resurgence in persistent consumer price inflation.

However taking a closer look at the aggregate data, I believe there is a high probability that inflation recedes rapidly from here, and the economy deteriorates faster than expected. I anticipate more rate cuts, and the return of quantitative easing. Maybe even another round of stimulus checks.

Why the Fed cut rates?

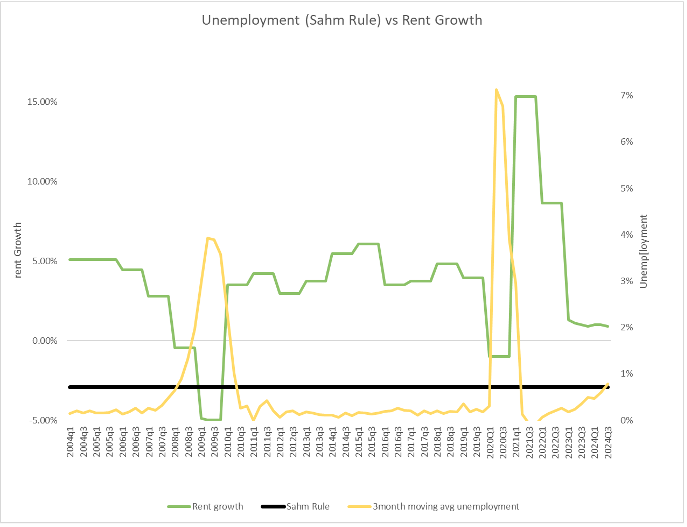

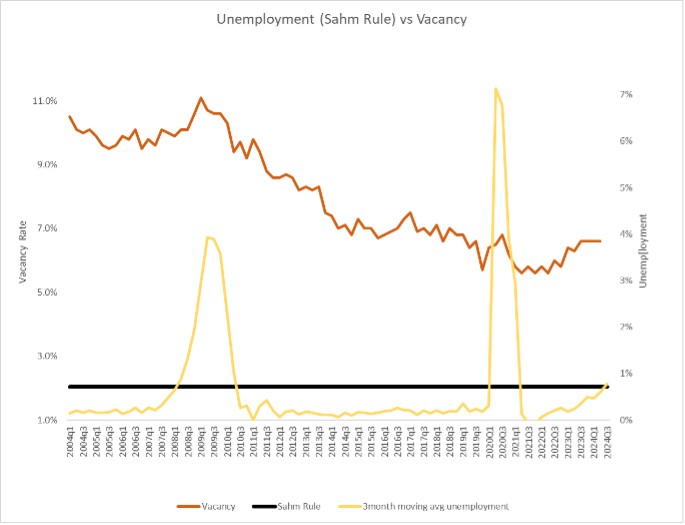

The most concerning data point in the economy at the moment is the unemployment rate. Unemployment recently passed something called the Sahm Rule. The Sahm rule states: When the three-month moving average of the national unemployment rate is 0.5 percentage point or more above its low over the prior twelve months, we are in the early months of recession.

Historically triggering the Sahm rule has preceded a recession 100% of the time. The Sahm rule’s creator, Claudia Sahm, a former member of the Fed’s Council of Economic Advisors, stated “I created the Sahm rule to send out stimulus checks automatically. The idea was to act fast to make the recession less severe and help families. The star was always the stimulus check, not the indicator that other people named after me.”

Each time the Sahm rule has been triggered, unemployment continues to increase, and nothing limits spending more drastically than losing your job.

Despite the Fed’s current narrative that increases in unemployment will stabilize, I believe that unemployment will continue to climb in the short term, as it historically has each time the Sahm rule has been triggered. For this reason, inflation should decline in the short term.

Unemployment has a direct impact on rent growth. Historically, each time there has been recessionary levels of unemployment, rent growth has been negative for 2-3 quarters.

In addition, rapidly increasing unemployment historically has an impact of increasing vacancy initially, immediately followed by a period of decreasing vacancy. It is likely that we can attribute the initial spike in vacancy to higher rate of evictions due to job losses, and the subsequent decline in vacancy to the fact that job losses lead to home foreclosures and a “down flow towards relative affordability”.

Looking at the charts above shows a distinct difference between the 2008 GFC and the 2020 Pandemic recession. The impact of massive government stimulus in 2020 kept mortgage delinquencies under control despite record levels of unemployment, additionally the stimulus spending fueled rent growth well in excess of the typical recovery rent growth. This shows the impact of government policy, and how stimulus spending affects the multifamily investment industry.

Modern Monetary Theory

Before we can begin to make predictions about what government policy may look like it’s important to understand how the government funds these stimulus packages. The Clinton administration was the last administration to run a federal budget surplus. Since then, the name of the game has been deficit spending, fueled by the Fed’s use of what some economists are now calling “Modern Monetary Theory” or MMT.

The foundations of MMT state that government deficit spending in and of itself is not the problem, as any government deficit spending results in equivalent surplus in the private sector. The real issue is the rate at which government increases deficit spending, and where they allocate spending, as rapid increases in surpluses into any one category of the private sector will result in demand outpacing supply, which ultimately results in price inflation.

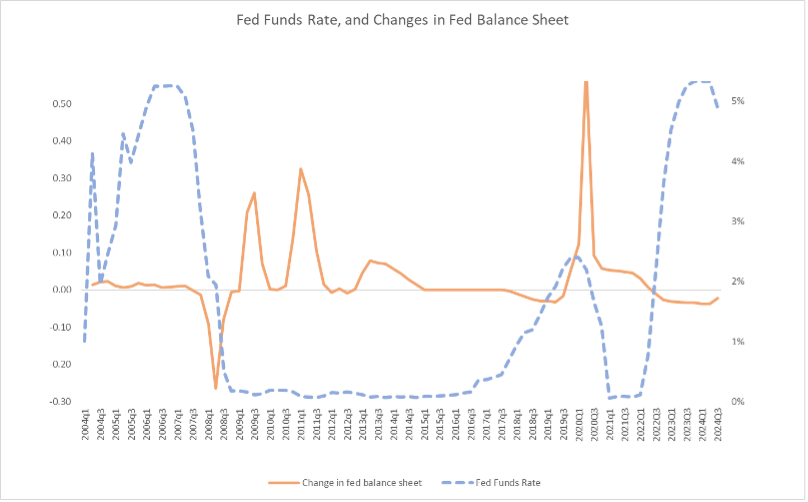

In terms of how monetary policy works in practice. The Fed has two main tools at their disposal. The Fed funds rate i.e. short-term Interest rates, and their balance sheet i.e. quantitative easing.

As the central banks of developed nations around the world have shown. The use of continued interest rate cuts is already in play, and the Fed has already begun to follow the central banker’s handbook, making this their first move.

There is a good chance that reducing the fed funds rate on its own will not be impactful enough to correct the economy and the Fed will have to step in with quantititaive easing to give additional stimulus to the economy. This is especially true given political timing, and the fact that we will be in the first year of a sitting presidential term, where the President will be incentivized to say that the Government has “fixed” the economy.

Quantitative Easing is also the mechanism the Fed and the Treasury Department use to “print money”, and refinance maturing U.S. Government debt. The Treasury Department issues new treasuries and if there is no market for all these treasuries the Fed joins the market and purchases them. This gives the federal government all the money they will ever need.

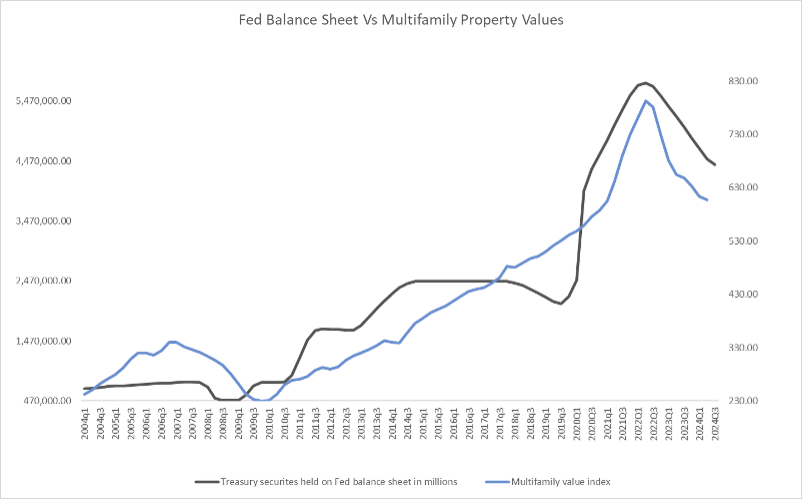

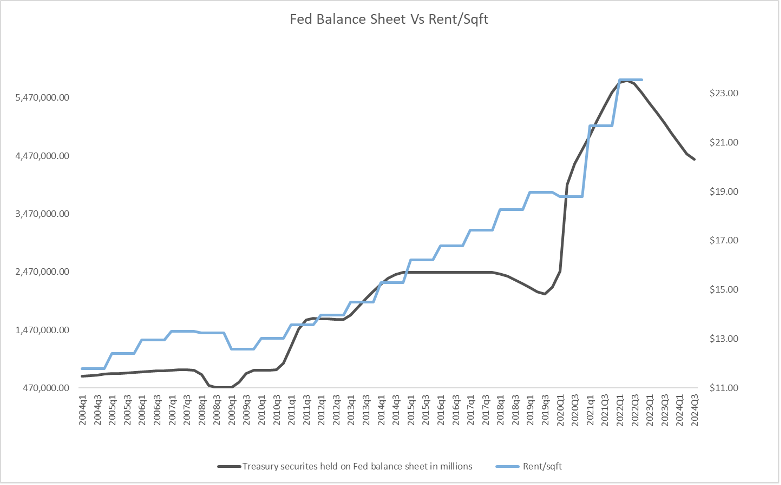

How the Government uses this money in response to the recession could have a significant positive impact for commercial real estate investors. As we saw from the covid stimulus spending that featured direct payments to individuals, and rental assistance checks to landlords, combined with increased local demand due to a massive shift in work-from-home migration. All of this led to outsized rent growth. Historically, the Fed’s balance sheet is highly correlated with multifamily property values especially when their balance sheet is increasing, as shown by the graph below.

Stimulus checks

Since the Treasury and the Fed can “print new money” the question becomes what the U.S. government does with this newly found money. This is called fiscal policy, and the government is historically fiscally irresponsible with the privilege.

Given that it is an election year I expect them to be especially irresponsible in their reaction to what is shaping up to be a painful recession, and Covid-19 changed the political playbook for fiscal policy.

It was a great socio-economic experiment and settled a long-standing economic debate of trickle-up vs trickle-down economics. That is, should the government give money directly to the American people or give money to the private sector lobbyist suckling at the teat of Washington via tax breaks, and large government funded infrastructure and technology projects?

The debate has now shifted away from where to allocate, and more towards what amount of money allocated to either type of stimulus best manages inflation and preserves asset values. In my opinion unproductive spending is unproductive spending, and while the government has a tremendous privilege to allocate finite resources, and capitalize highly beneficial but extremely long-term projects, the government historically fails to put their “free money” to any real productive use. They will use the money the way they always have – buying votes, lining pockets, and creating more problems than they solve.

Regardless of who wins the election both parties will be highly incentivized to do some level of stimulus spending and will direct a percentage of that spending directly to the people, because the covid stimulus checks showed politicians a new way to buy votes.

It showed the economist that given money, the American people will consume, finance, invest, and save. At least until inflation consumes their savings.

And it showed central banks that the fastest way to jump start the economy is 1000 milligrams of monetary stimulus, injected directly into the wallets of the American people.

I think that there is a high probability that some of this stimulus gets directed towards subsidizing unaffordable housing cost and this will have the impact on increasing rents across the market. The size of the Fed’s balance sheet shows a high historic correlation with rent/sqft, as shown in the graph below.

To learn more about how we can help you to generate superior investment results through professionally managed Real Estate investments, click here to register for our investor club.