Last week the Bureau of Labor Statistics (BLS) updated their estimate of how many jobs were created in the country this year, and they revealed that the figure was 818,000 jobs lower than initially indicated. The report marks the largest downward revision since 2009 and suggests that the labor market began losing steam earlier than initially thought.

This is concerning for a number of reasons

Firstly, it calls into question the validity of this BLS statistic. Each time the BLS produce a jobs report, the market is reacting to the news, good or bad. However, the magnitude of these revisions often outweighs the signal of the original news, and this really makes the whole news-market reaction process a bit of a farce.

Secondly, the revised numbers show that the economy is actually not so strong, and weak labor statistics generally have a direct impact on operating performance for multifamily real estate.

A weaker job market has the potential to affect the fortunes of renters. This can mean higher vacancy, higher bad debt and lower rent growth. And all of this works to reduce net operating income in the short term.

Layoffs as a leading indicator

A WARN (Worker Adjustment and Retraining Notification) notice is a notice required by the federal WARN Act in the United States, which mandates that employers with 100 or more employees provide at least 60 days advance written notice of a plant closing or mass layoff affecting 50 or more employees.

The notice is intended to provide affected employees with sufficient time to prepare for the loss of their jobs and to seek alternative employment.

Data of these notices is publicly available (warntracker.com), and we can monitor trends in WARN data to assess likely future employment and variations by State.

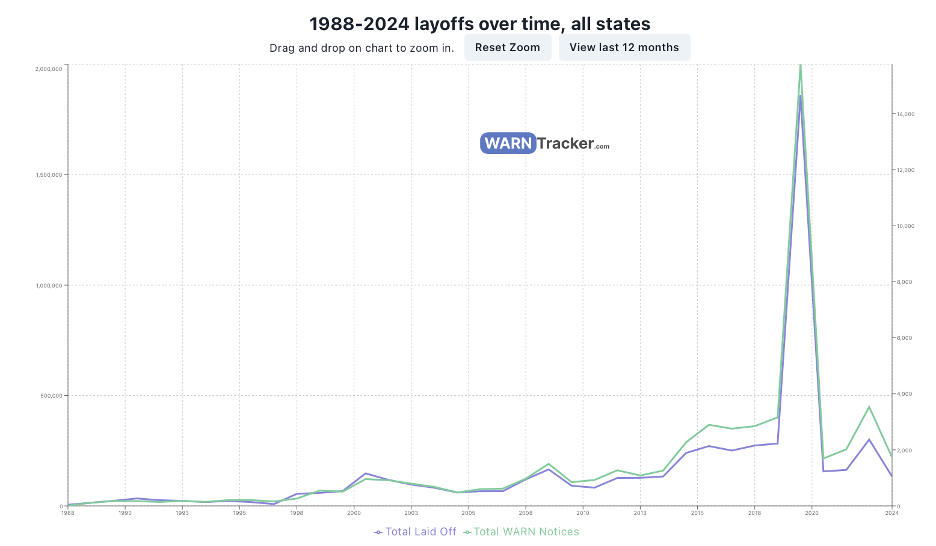

Below is a snapshot of nationwide layoffs by year. 2020 stands out as a very large outlier. However, it can also be seen that layoffs have started to peak in late 2023 and early 2024 (Note that the final data point in 2024 represents only six months of the year up to July 2024, so we still have six months of reporting to come in the current year).

Statewide data

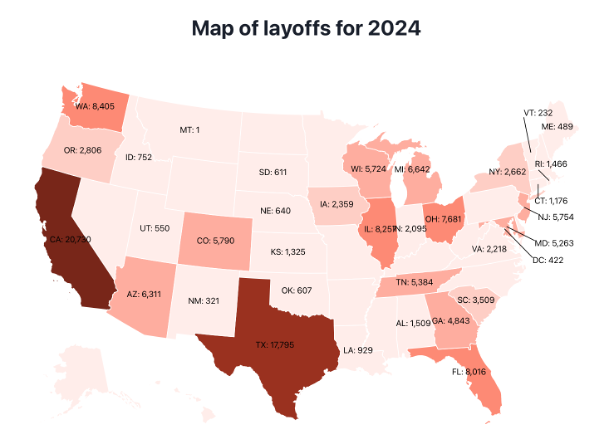

Data by State shows the variation in seen in each State and this provides a useful indicator of where the largest impacts of layoffs are being seen.

What should we do about this data?

We pay close attention to data about the state of the economy, because when the economy goes bad, it is likely that our residents face difficult and uncertain financial times and as mentioned, this can have a direct impact on occupancy, bad debt and the ability to push rents.

Our onsite teams maintain close communication with all residents, particularly in these types of environments, as we want to be aware of any tenant that starts to face financial difficulties. This allows us to stay ahead of any bad news so that we can find a mutually beneficial solution if a tenant loses their job or is unable to pay their rent.

We may also shift our strategy to maximizing occupancy at the expense of rent growth, if we think that the market cannot currently support higher rents. We can do this by focusing more efforts on resident retention than marketing for new leases.

From an acquisition perspective, we like to use the state-by-state data to give an indication of where employment may be weakest in the short term. Each recession can affect a different segment of the workforce and forward-looking layoff data can be a great initial indication of the geographies (and hence potential employment segments) that may be most affected in the current economy.

Conclusion

The latest employment data suggests that we may not be in for a soft-landing after all. It could be a rocky road ahead, and if the economy does weaken, we should expect that this could have an impact on operating performance of multifamily assets in the short term.

Longer term, there are a number of positive factors for multifamily. We would expect interest rates to fall at some stage, in response to a weakening economy, and this will have a positive impact on capital flows and cap rates, which will increase property values.

History has also shown that in difficult economic times, less people buy homes, and more are forced to rent. In the medium term this will create higher demand for rental housing and when this happens, it is likely to put upward pressure on occupancy and rents.

To learn more about how we can help you to generate superior investment results through professionally managed Real Estate investments, click here to register for our investor club.