“it’s only when the tide goes out that you discover who’s been swimming naked” – Warren Buffet.

Warren Buffet is one of the most prolific investors of our time, but what makes him such a successful investor? One could argue that it’s his career, made up of sound investment decisions over many, many years.

However, what is it that determines a sound investment?

The most obvious approach may be to look backwards and see whether or not the investment performed. The problem with this though, is that not all performance is the result of business performance or asset fundamentals.

Sometimes an investment’s performance can be driven up by speculation in the market. Speculation is very similar to gambling in that speculators will place bets that an asset will continue to appreciate based solely on the fact that it has appreciated in the past.

Lots of speculation is what can turn a strong bull market into a bubble.

You may have heard the quote “A rising tide lifts all boats”… a frothy bull market can produce a big asset bubble that will cause the value of assets to appreciate beyond what their underlying fundamentals can justify. Buffet’s Quote “it’s only when the tide goes out that you discover who’s been swimming naked” is a statement about investors taking on unseen excess risk in order to chase higher rates of return. Good investment requires a long-term view, and sound investment strategy focused on reducing risk.

There is no certainty of success in investment. Only probability of success or failure.

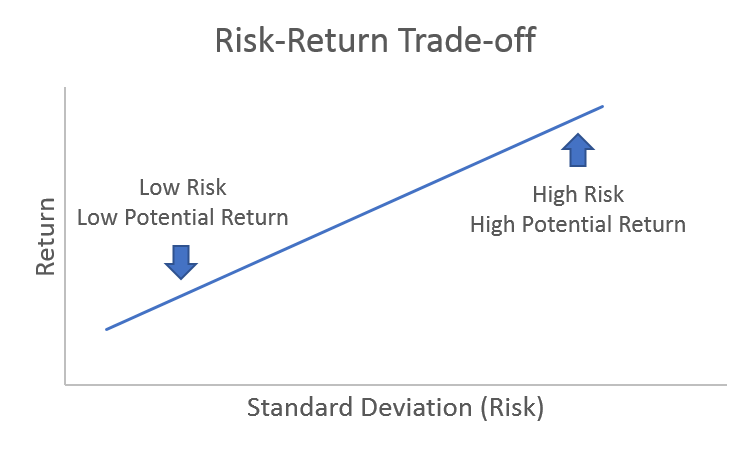

As investors, we label probability of failure as “risk”. The distinguishing factor between investment and speculation (or gambling), is the asymmetric risk to reward structure of an investment. Good investments have a significant delta between the expected rate of return and the risk investors take to generate this return (see figure 1). This is what Investors refer to as the Risk Reward Ratio.

While you want to find investments with the highest return and the lowest risk possible, it is important to understand that Risk and Return tend to move in the same direction.

If a particular investment has a lot of risk, then the return on the investment must be higher in order for investors to be willing to take on that risk.

The opposite is also true – if a particular investment has a very high rate of return, it will have a much higher risk profile than alternative investments with a lower rate of return.

The ability to make great investments comes from the ability of the investor to best understand and mitigate the risk factors of a particular investment and seek out investments with an asymmetric risk-return profile.

Multifamily real estate as an asset class is inherently less risky than many other investment alternatives

However, all investment involves some level of risk, and it is important to understand the specific risk factors that pertain to multifamily investing in order to utilize an investment strategy that will generate the best possible result.

It is also important to understand that some risk factors are cyclical in nature and your strategy may have to change over time, with changing market conditions.

Risk factors for passive multifamily investments can be broken into four categories:

- Sponsor risk

- Market risk

- Property risk

- Leverage risk

Sponsor Risk

Sponsor risk comes down to the experience of the sponsorship team and how realistic the business plan and underlying assumptions are. Investors can mitigate sponsorship risk by doing proper due diligence on the sponsorship team, underwriting, and business plan.

It is important to ask lots of questions prior to making an investment with a new sponsor. Although as a passive investor you will not be the one executing the business plan, it is important that you have a clear understanding of the business plan, and the underlying assumptions.

You’ll need to take a close look at these assumptions and decide if you think they are realistic, and that the business plan as a whole is achievable. For example, if median incomes in the market are $35,000 it is unlikely that the tenants in the area will be able to afford rents of $2,000/month, as this rent will represents 68% of their monthly income. Additionally, if the property historically has a high level of bad debt, it is not realistic to reduce this to zero in year one of the business plan.

You need to have absolute confidence in not only the underlying asset, but also the sponsor’s experience and ability to deliver on expectations.

Market Risk

There are many contributing factors to market risk such as the local job market, income to rent ratios, crime, oversupply of housing, declining population, higher geographic operating cost, and local laws and regulations.

Mitigating this risk comes down to proper due diligence. Best practice is to do thorough research on the markets that you are considering investing in, prior to reviewing any specific investment opportunities. Market risk factors can often be cyclical in nature and markets can change overtime, so it is a good idea to stay up to date on all market research, even after you have invested in a market.

Property Risk

Property risk refers to the physical condition and age of the property. Older properties can come with higher unforeseen costs from deferred maintenance and change orders during renovation. This can lead to significant cost overruns which may result in lower returns, or even a capital call that will dilute the investor’s position. You’ll want to make sure the sponsor has run a detailed physical inspection process prior to investing, and that the cap-ex and renovation budget were generated using actual quotes for a clearly defined (and accurate) scope of work.

Leverage Risk

One of the advantages of real estate investing is that lenders are willing to lend on the asset, which allows investors to essentially invest using the lender’s much cheaper capital. However, there is a tradeoff…

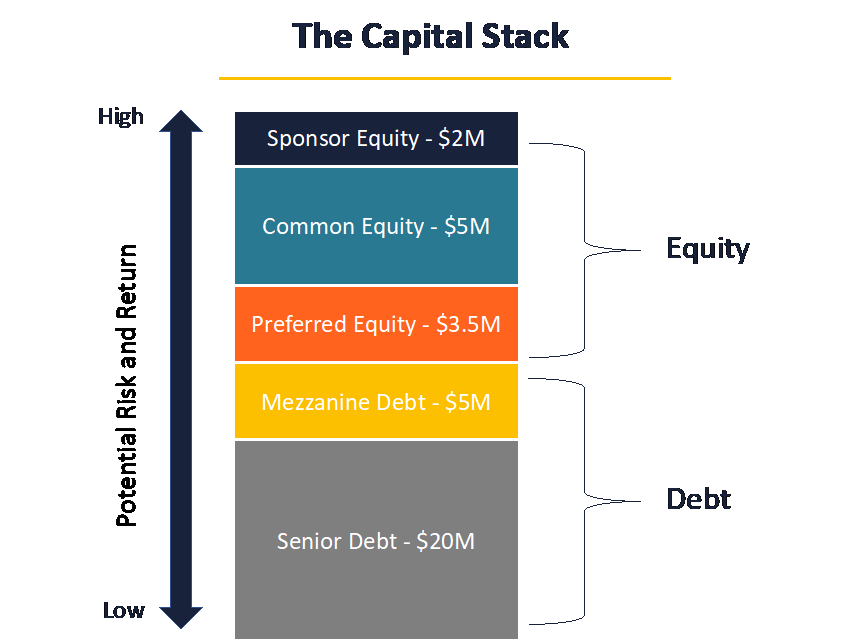

The lender is the last capital in, and the first capital out. In order for investors to turn a profit, the investment must make enough money to service the debt and pay back the lender before any excess profits can be enjoyed by the investors.

It is also very important to understand your position in the capital stack and the distribution waterfall for each position in that capital stack.

The capital stack pays positions at the bottom first. The higher you are in the capital stack, the more money the investment has to generate in order for you as an investor to get paid. Therefore, the higher up in the capital stack, the more risk there is in your investment position.

Leverage can be a great tool that boosts investor returns, but it is important to remember that higher returns also mean higher risk, and overleveraging a project can add excess risk for investors.

Mitigating risk is the key to making great investments

Most risk can be mitigated by proper due diligence, and effective investing strategies. As limited partners, you need to make sure that you understand the risks inherent in multifamily real estate and assess whether the sponsor of an investment is taking adequate steps to manage and mitigate these risks as best they can.

Then, before you commit to an investment, you should assess whether the return being projected is commensurate for the risks of the project. If the risks seem too high, or the return too low, then that is probably not a great investment to be making.

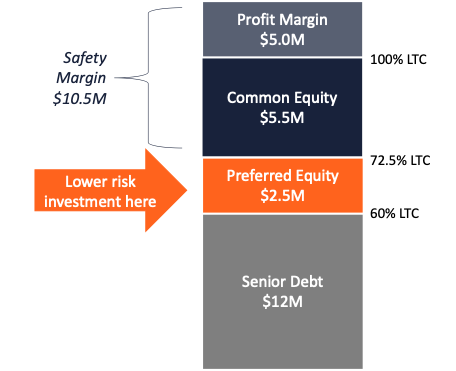

Lower risk investments: Preferred Equity

One valuable strategy to mitigate exposure to risk is to form a diversified portfolio and allocate a portion of your portfolio into investments that sit in a lower risk portion of the capital stack.

A great example of this is to invest in preferred equity positions that sit in a lower position in the capital stack, rather than common equity positions.

This approach provides investors with better capital preservation on a portion of their portfolio, effectivly hedging some of the riskier common equity positions while also providing more consistant cashflow that can be used to cover living expenses or be reinvested for greater velocity of money.

If you would like to learn more about identifying risk factors, and how to mitigate risk by investing in preferred equity positions, please register to attend our next Webinar “How Not to Lose Money investing in Real Estate Syndications” which will be held at 8pm EST on Thursday 8th September. You can register using the button below.