Like many investors, I am looking towards 2024 and hoping for a better year with better opportunities. 2023 has brought a lot of stress to commercial real estate, with the historic rise of interest rates showing just how fragile our highly leveraged financial system is.

During the past year, we have seen how closely correlated real estate values are to interest rates, and we have seen a large number of capital calls, as sponsors try to save deals. Unfortunately, we have witnessed many of these attempts fail, with some properties foreclosed on, and a lot of investor capital lost.

As painful as it is to live through these experiences, much of this is just part of the cyclical nature of investing, driven by short term debt cycles and shifts in supply and demand.

But after the crash comes the recovery, and like a phoenix rising from the ashes, so too will the real estate market rise, and the best real estate investing opportunities come from buying at great discounts that only arise from periods of turmoil and economic distress.

While I am not entirely certain that we are done experiencing the pain, given the large number of looming debt maturities, I do believe we will start to see opportunities in 2024 that may be overlooked, and now is a good time to discuss what to look for.

Discounts to replacement cost

Opportunities in 2024 may look differet to what we are used to seeing, and with prudent underwriting returns may look lower than in the past. However it is important to put into context the environment in which we are purchasing, and understand the discount to replacement cost, provided by a beaten down real estate market.

New opportunities may require investors to take risks and buy into what many others may believe is an uncertain market, but it is in times like these when investors are rewarded for taking risk.

Many markets have seen real estate values decline by 30% or more, and recent large amounts of new supply going through lease up have pushed down market rents, lowering NOI and further devaluing commercial real estate. However, the cost to replace this real estate continues to go up. Construction materials, trades labor, financing cost, builder risk insurance, and the cost of risk capital are all very expensive, and while financing costs may come down over the next few years, hard construction costs will continue rise.

In 2024 there is a strong case to be made that some commercial real estate may be significantly undervalued, as investors are sensitive to perceived risk, and more focused on valuations based on current NOI, spread to risk-free yields and rising market cap rates, while ignoring the current discount to replacement cost.

Economic strain leading to increased short-term risk

Investors will need to keep a close eye on a few risk factors that could negatively impact their investments in 2024. The Federal Reserve’s recent announcement of interest rate cuts in 2024 has certainly increased positive sentiment towards real estate investing. However, it is important to understand the reasoning behind the Fed’s decisions.

Contrary to what many believe, interest rates do not directly control the real economy, and can only indirectly influence aggregate demand. In fact, the relative strength of the economy is what determines where the Fed sets rates.

When the economy is strong, the Fed raises rates to slow aggregate demand and tame inflation, When the economy is weak, the Fed lowers rates in an attempt to stimulate growth and increase aggregate demand.

The fact that the Fed has made such a drastic shift from “higher for longer” to “3-4 rate cuts in 2024”, and completely skipped over the transitionary step which would have been “holding rates flat at the terminal rate until pricing declined, and the labor market cooled down”, is a strong indication that the economy is much weaker than the media or the government would admit.

In reviewing the Federal Reserve’s Beige Book report from November 29th, 2023 which was released roughly two weeks before the Fed announced their outlook, we can clearly see Fed data showing a significant slowing of the economy, with 8 out of 12 districts reporting slowing or flat economic activity.

In addition, the report details a softening labor market, declining prices, and weakening manufacturing, banking, and overall consumer spending. While I believe that we have already been in a recession for some time now, it seems that in 2024 we will begin to see some of the more negative effects of a recession – mainly increased unemployment, and subprime loan defaults.

While the value of subprime loans relative to the overall debt market is much lower than it was in 2007, we can still expect loan defaults to occur, as unemployment increases. These loan defaults will continue to self-reinforce the downward trajectory of the economy, as credit markets tighten, and less borrowing leads to less spending, which will lead to less income, and even less spending and borrowing.

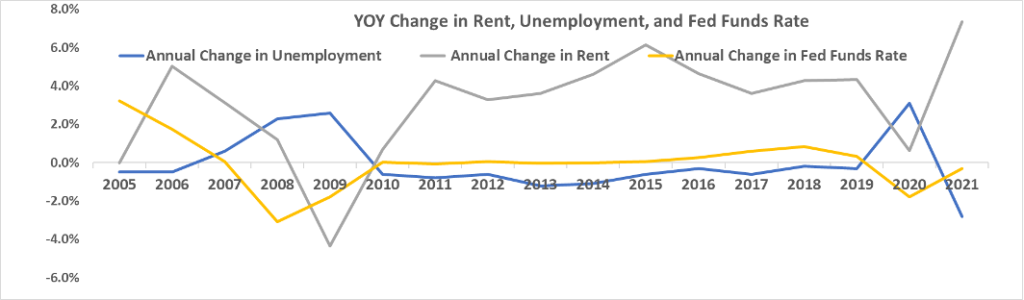

Home mortgage foreclosures, job losses, and unemployment will cause an increase in rental demand for multifamily real estate. However, rising unemployment will also lead to slowed or even negative rent growth. We saw this back in 2009, and again in 2020 at the onset of the pandemic, as shown in the chart below.

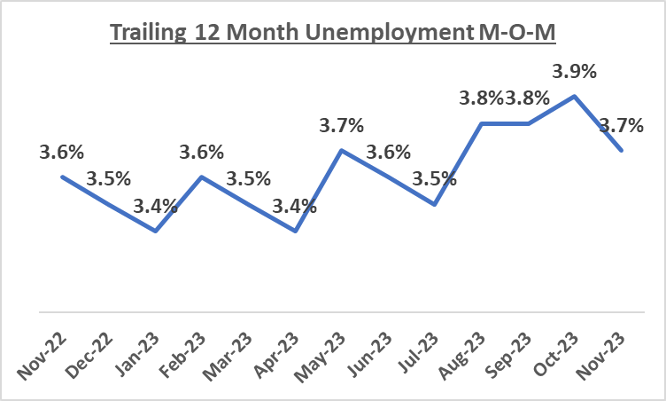

While the trailing 12-month unemployment rate is currently trending upwards, we have only seen a 50 basis point increase from trough to peak. While we do expect unemployment to continue to rise, this time may be slightly different, as we have a significant change in demographics with baby boomers starting to enter retirement and leave the work force.

This could change how the recession and recovery play out, by affecting reported unemployment. As baby boomers leave the work force, this could lead to a continuing tight labor market. Although this may dirve higher wage inflation in the short term, this could lead to an expedited economic recovery.

While it is tough to say exactly how high unemployment may go, we can get a rough idea of how high the Fed expects unemployment to rise from their current Fed Funds rate projections. The Fed is only projecting a 75-bps reduction in Fed Funds rate for 2024, and a 100-bps reduction for 2025.

However, the total projected rate cut from 2023-2027 is 287 basis points, compared to the actual 480-basis points of rate cuts that was executed from 2006-2010. During the 2006-2010 period, we saw unemployment increase by 440 basis points. If we assume similar comparables this time around, we may only expect to see unemployment increase around 260 basis points.

What we can say with certainty, is that higher unemployment will result in lower rents, and lower revenues for property owners. So, investors looking at opportunities in 2024 should look very closely at the local economy and seek out markets with strong and diverse employment, and project flat to declining rents for the next 12-18 months.

Supply pipeline creates optimism for the medium term

Another important factor for assessing potential opportunities in 2024 will be understanding the supply pipeline, and the impact that lack of supply will have on future rent growth.

We saw evidence of this in the post-Covid migration boom precipitated by the work from home trend. Markets that saw tremendous inbound migration had proportionate increases in housing demand.

However, unlike simple consumer goods, ramping up housing production to meet demand cannot be done in short order. It takes at minimum of 24-36 months to deliver new housing to the market. Some of the markets which experienced this increased demand saw rent growth upwards of 35% in 2021. This surge in rent growth continued while developers and builders scrambled to get projects permitted, constructed, and delivered to market in late 2022 and 2023.

Now that these projects are being delivered, and supply is more closely balanced with demand, we are seeing negative rent growth of -5% to -15% in some markets.

While the last 8 quarters have seen a large wave of new deliveries, the next 8 quarters does not have much in the pipeline. This is due mostly to the increased cost of financing new developments and the current risk appetite of investors for these types of projects.

So, while we are seeing a glut of supply currently, once this supply is absorbed, we are not likely to see more supply anytime in the near future. Chances are that we will return to a market where housing demand outpaces existing supply, and future rent growth will be much higher than we expect.

A Case for Optimism and Opportunity

While I am traditionally a very risk averse investor, I recognize that there are tremendous rewards for taking risks, and I believe that those willing to step out and take calculated risks in 2024 will be handsomely rewarded.

The deals done over the next 12 months may not look like your traditional multifamily deals of the past, but there are certainly discounts to be had, and plenty of problems to solve.

For those who can get in early, there is a record setting amount of institutional dry powder sitting on the sidelines ready to return to the market and drive down cap rates once the future becomes more certain. As a result, those who hesitate to jump into opportunities will likely miss out on some really incredible deals. To my fellow investors who have suffered and fought their way through 2023, remember “Carpe Diem” as we head into 2024.

To learn more about how we can help you to generate superior investment results through professionally managed Real Estate investments, click here to register for our investor club.

Thank you I have just been searching for information approximately this topic for a while and yours is the best I have found out so far However what in regards to the bottom line Are you certain concerning the supply