Many of us are searching for good investment opportunities in commercial real estate. While I believe the first quarter of 2024 will be relatively slow, investment opportunities should improve in Q2, driven by debt maturities and improving sentiment in capital markets.

That means that now is a good time for passive investors to get back to basics and review the fundamentals of what distinguishes a good investment opportunity from one that may present more risk than return.

The biggest challenge facing passive investors in 2024, is developing the courage to step back into the market and invest again. The best way to overcome fear and indecision is with information. It is easier to take action and make decisions if we have more information that helps to identify and mitigate risk.

So, we want to help. We are dedicating the rest of this month’s blog to going back to some of the fundamental basics of evaluating good multifamily real estate investments from a macroeconomic and demographic perspective.

Sponsor Risk

The biggest risk in any deal is sponsor risk. A great deal can always be turned into a poor investment simply by having inexperienced and ineffective leadership.

I have a good friend who used to own a restaurant. By all measures he was a successful entrepreneur, and a good leader. The skills and experience he developed throughout his 40-plus year carrier in the restaurant industry allowed him to build a very successful business. He had a great product, a loyal customer base, and quality dedicated employees on his team.

As he moved towards retirement, he decided he would sell his restaurant. In the sale, he provided the buyer with the secret recipes for his product, his systems, his staff, the brand, his vendors, and he agreed to stay on for 120 days after the transact to help train the new owner.

Then, within two years after the sale, the new owner closed the store and declared bankruptcy…

Why did the successful business which had been going strong for decades suddenly die after this transaction? The buyer was provided all the information and resources the prior owner had used to build and run the successful business.

If you ask the buyer, he will tell you it was the economy. The market changed and killed his once successful business. However, if you ask the customers, and former employees you find the real answer. The new owner had no relevant restaurant experience, he didn’t understand the basics of the restaurant business or the roles of the team members, and in trying to change something he did not understand, he made it worse.

Knowing how a business is run is not the same as knowing how to run a business.

As a passive investor the best thing you can do to find good investments, is to find a good sponsor with relevant experience and ask for references. Speak to someone who is already invested with the sponsorship team. This way you don’t have to take the sponsor’s word, you can hear firsthand from another passive investor about what it is like to invest with that sponsor.

Market Risk – Demand drivers

The next item to consider when determining whether you have a good deal or not, is the market. Rent pricing and property values are determined by supply and demand and I always start with demand.

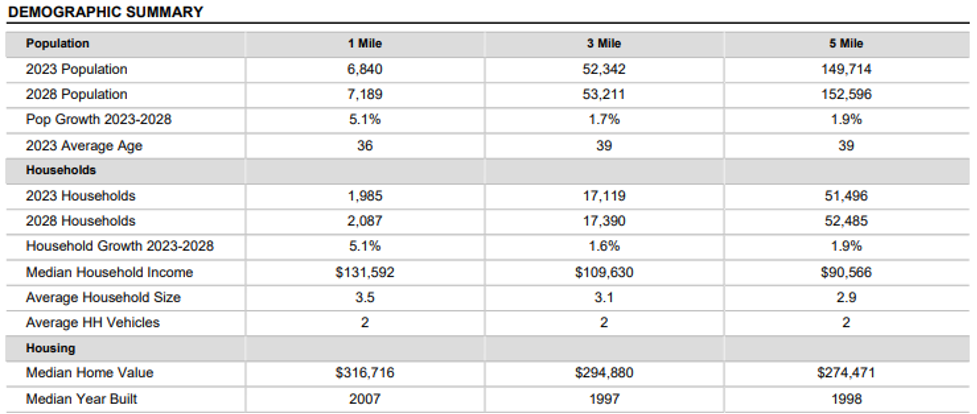

We obviously want to invest in an area that has population growth, but more specifically we want population growth in the immediate vicinity of the subject property. Below you can see an example, where population growth within a 1-mile radius of a property is stronger than the 5-mile radius.

This is a good example of strong demand potential. I say potential because population does not always mean renter population.

To get a better sense of actual renter demand we need to look at household formation growth, median incomes, and home values.

First, we have household growth which is a positive sign of productive population growth. As a generalization this means the population growth is represented by individuals who are gainfully employed and can afford their living expenses, which results in the formation of more households.

Second, we have median income or more specifically, median income to rents as a ratio. In our example, let’s say the median rent at the subject property is $2,100/month or $25,200 annually. This means that the median income in the area is 5.22x what the median housing expense is at our subject property. This is a very healthy ratio with a lot of headroom for future increases in rents. Any income to rent ratio of 3.0x or higher is generally considered to be affordable.

Lastly, taking a look at home values in the area can provide insight into rent demand versus home ownership demand. Considering the median home value of $316k in our example, and assuming residents in the area have the $63K (20%) standard down payment, the monthly PITI mortgage expenses will likely be $2,387/month. Our average rents of $2,100/month compare favorably and show that it is cheaper to rent than to own in this market. Another positive driver for renter demand.

Overall, the demographics of this deal show that there is strong demand for housing, which will cause rents and property values to growth in the long term.

Market Risk – Supply drivers

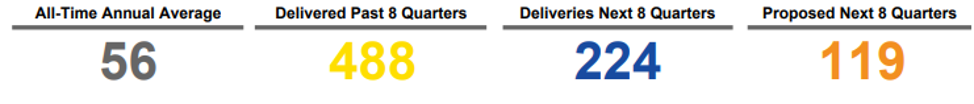

Now let’s take a look at supply. The table below shows deliveries of new supply within a 1 mile radius of the subject property, as well as future supply in progress, and planned new deliveries.

As you can see relative to the All-Time Annual Average, supply (or deliveries of new apartments) is increasing at a huge rate. The delivery of new supply will likely drive down rents in the short term, as these new properties offer low rents and concession during their initial lease-up.

However, there are only 343 units (223 confirmed deliveries and 119 proposed deliveries) scheduled to be delivered over the next 8 quarters, and population is projected to grow by a higher amount: 349 within a 1-mile radius (based on the 2028 Population projection in our earlier Demographics exhibit), and 2,882 within a 5-mile radius. This shows us that there is a high probability that longer term demand will still outweigh supply.

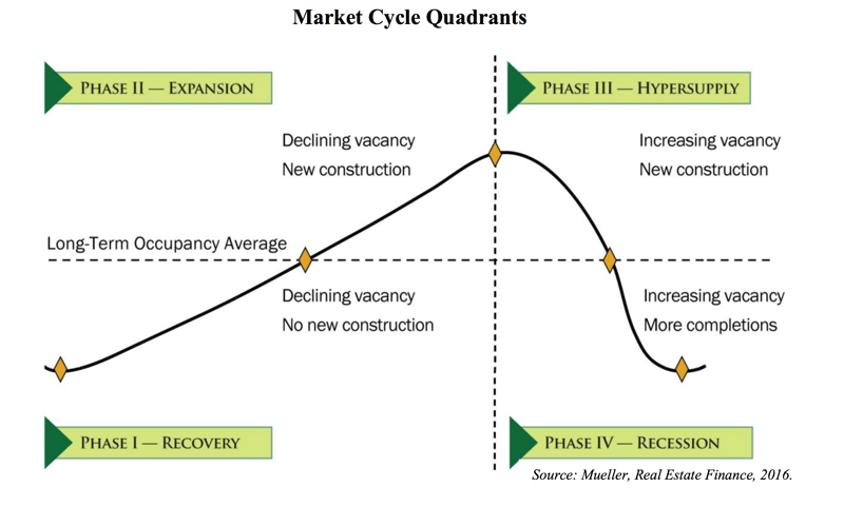

If you remember the basics of the real estate cycle, rents and property values will be determined by housing under supply vs oversupply. The direction of the market and status of supply can be determined by trending occupancy relative to the long-term average, and the ratio of new supply to absorbed supply.

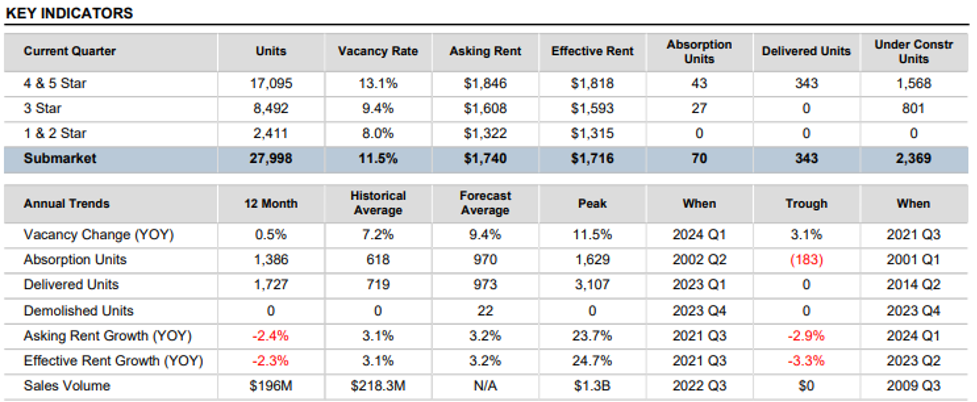

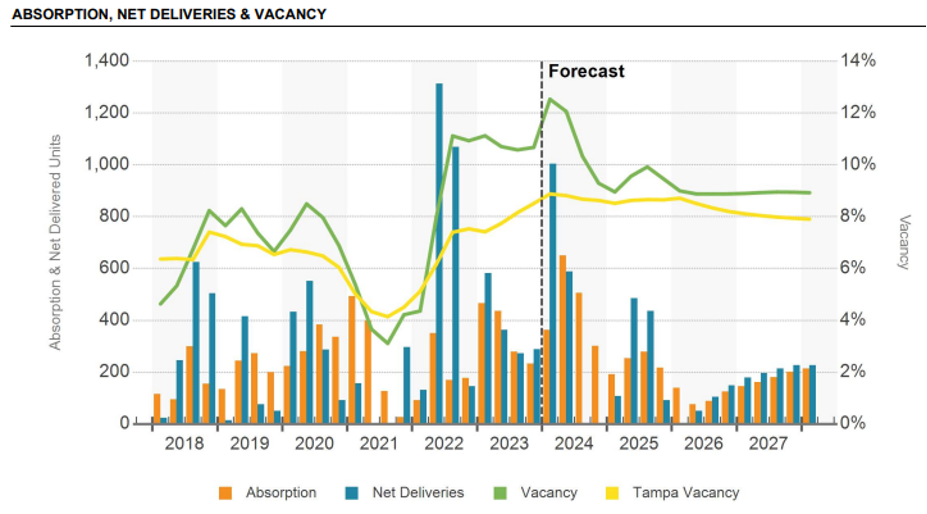

The chart below shows the long-term averages for vacancies, rent growth, net deliveries, and sales volume for the entire market. Keep in mind that this data is for a much broader area than just the 5-mile radius around the subject property. This is the whole market in aggregate, and while this will affect the the subject property, it is best practice to put this data into context with the new deliveries in the immediate area.

You can see above that the long-term historical vacancy is 7.2%, and the forecast vacancy is 9.4%, which is above the long-term average, but still below the peak vacancy. This means that the market is likely moving towards recession from hyper-supply.

This also means that now may be a good time to buy property cheaply, even though you should expect rents and property values to stay low or decline in the short term.

Putting this into current market context, the historic rise in interest rates has made it near impossible to get any new development project going, because the cost of capital is so restrictive. Therefore, once the market absorbs scheduled new deliveries there will be no more new deliveries in the short term and we can expect the recovery phase to therefore be relatively quick, as the market returns to a supply constrained conditions. This would be expected to drive rent growth, and property appreciation.

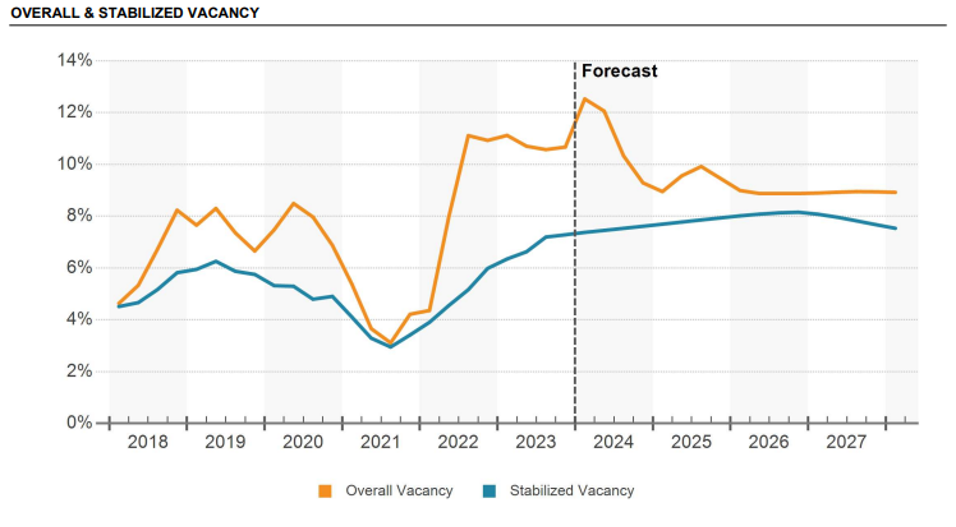

We can see this in the chart below, which shows net deliveries, absorption, and vacancy. You can see the gap in projected new deliveries in Q2 2024 through Q1 2025 (where there is a distinct lack of blue bars). It is important to note that the vacancy on this chart is reflective of both stabilized properties, and new deliveries which start at 100% vacant.

The below chart shows the distinction in vacancy between stabilized property and new deliveries.

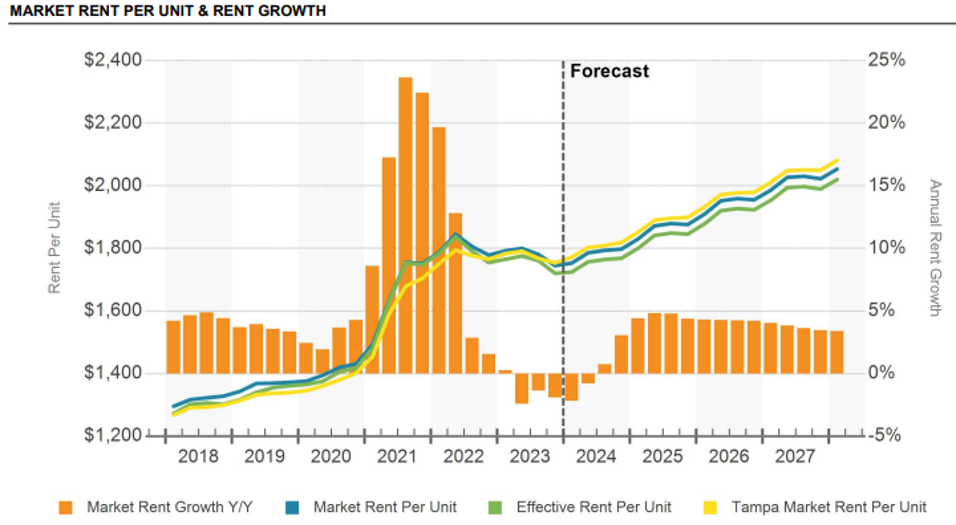

Rent Growth

As we have discussed, market rent growth will largely be determined by supply. This is reflected in the chart below which shows negative rent growth during the quarters where the new supply is leasing up, and then positive rent growth resuming once the new supply is absorbed (focus on the trend in orange bars in 2024 and 2025 and beyond).

Planning for overly optimistic rent growth without consideration of new supply is one of the most common mistakes we see when reviewing other sponsors’ deals. It’s important to note that even if the market as a whole is experiencing negative rent growth, the subject property may be able to achieve positive rent growth if there is a real loss to lease, or a reposition through value-add renovations.

However rent growth at the property will never be possible if the incomes of the residents don’t support the projected renovated rents. Which is why it is so important to look at income-to-proforma rent ratios when a project has a value-add reposition.

Property values, Cap rates and exit valuation.

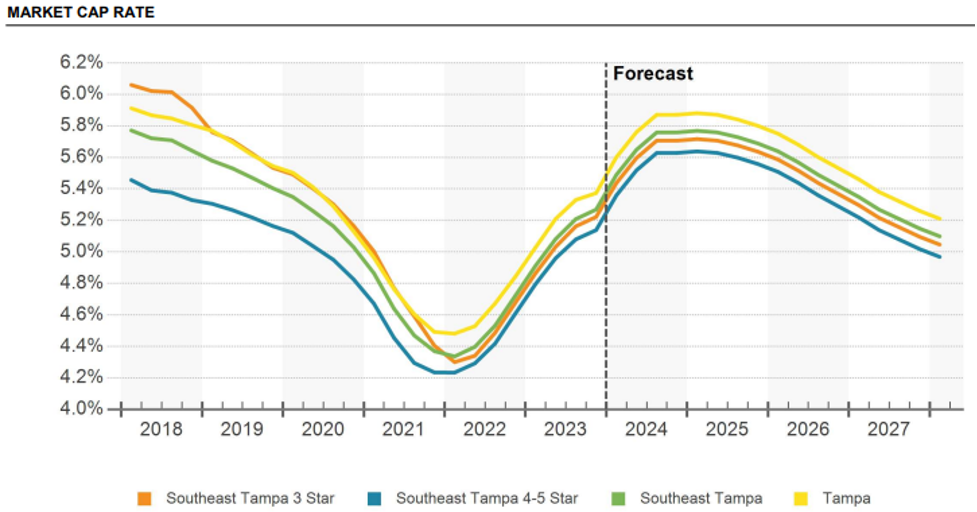

Cap rates are one of the most misunderstood, and one of the most crucial concepts in commercial real estate investment. Almost everyone understands that cap rates are the metric that determines property value based on the cashflow the property produces, but most investors don’t understand what causes cap rates to move, and exactly how sensitive property values are to market cap rates.

There are three things that affect cap rates, which in order of their impact are

- Cost of capital i.e. interest rates and expected return on equity investments.

- Perceived expectations of future growth, and

- perceived expectation of risk.

Right now we are in an environment where relative cost of capital is very high, expectations of future growth are low given the looming recession, and perceived risk is high for the same reasons. All of this has resulted in a massive expansion in cap rats, and a reduction in property values.

In the chart below you can see that cap rates have risen from 4.3% to 5.2% on our example, and are expected to go even higher in the near term.

Transaction volume has plummeted, and property values have dropped in the last twelve months. While it may not feel like it to most investors after the beating we took in 2023, now is the time to buy!!

As the old saying goes, you don’t make money when you sell real estate you make money when you buy real estate, and now is the time to buy cheap real estate. Yes, rent growth will be slow or even negative in the short term, but the power of cap rate compression in the long term will lead to outsized returns.

As an example, using the cap rate projection below – If you bought a property with $100k NOI today at a 5.2% cap rate, experienced no rent growth, and sold in 2027 at the projected 4.9% cap rate, you will have made $3.3 million, just by buying at the right time when everyone else was scared to step back out into the market.

I know many of you are looking at the chart and saying “but there will be better deals at the end of 2024 when the market bottoms”, and yes you are correct. Buying at an even higher cap rate will make you even more money, but everyone I know who waited last time and tried to time the bottom of the market missed it. Pigs get fat, hogs go to slaughter. It is better to be early, than late.

Conclusion

I do adamantly believe that there will be great investment opportunities in 2024, and the biggest challenge facing passive investors is to develop the courage to step back into the market and invest again, where it makes sense.

If you are interested in accessing the Deal Review Desk for any passive investment that you are looking at, please click this link to register.

To learn more about how we can help you to generate superior investment results through professionally managed Real Estate investments, click here to register for our investor club.