One of the advantages of investing in long term rentals is the ability to actively manage the investment. Unlike stocks and other investment vehicles, there is a level of control beyond just the ability to buy and sell the underlying asset.

Quality property and asset management can make the difference between properties that perform in times of economic turmoil and properties that go bankrupt. A good asset manager is continually assessing market conditions and identifying potential risk factors.

In the real estate investing industry so much attention is focused on rent growth, but very little attention is given to hedging the downside risk of declining rents and that is what we want to discuss this month.

There are two market factors that contribute to a decline in rents. The first is over supply of housing, and the second is unemployment.

Economics 101: Supply and demand

Oversupply is very simple and goes back to economics 101. An oversupply of a product or service will lead to a decline in price, all else being equal.

When assessing the risk of oversupply in a market, it is important to look at new permits, and delivery of new units to the market. If the new units are near your property and are a property type that is competitive with your property, you need to anticipate that rents will decline in the short term while the market absorbs this new supply.

It is also important to ensure that you have adequate cash reserves for the business to continue to cover expenses and debt service during this period of declining rents, as the new deliveries are absorbed by the market.

Employment trends matter

As we head into 2023, there is a strong chance that higher unemployment will contribute to a decline in rental rate. Yes, there is always a demand for affordable housing and yes, this makes multifamily relatively recession resistant. However, just because the asset class is recession resistant doesn’t mean that we should expect high levels of growth during a recession. Although there is always demand for housing, the ability to afford housing is diminished by higher unemployment.

As a general statement, it simply means that our invested capital is slightly safer during turbulent times. However, results will vary by asset and by geography.

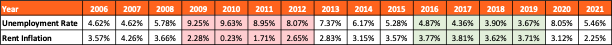

In the table below, you can see the historic correlations between unemployment and rent growth in the USA. The period of high unemployment 2009 – 2012 did lead to lower levels of rent growth across the country. We can also see that in the period 2016 – 2019 when unemployment lowered each year, rent growth on average was close to all-time highs.

Source: BLS, Propertymanager.com

In times of stress, stick to investment fundamentals

Although I believe that in the long term multifamily will continue to perform, and that the destruction of demand through higher interest rates is precipitating a much-needed reset in property price, I expect real estate investors will need to exercise caution in both the management of the their owned assets, and in the acquisition of new properties in 2023.

There is opportunity coming, but there is probably more risk in the system than opportunity at this point in time.

Investors must remember the three immutable laws of real estate investing that were made famous by Joe Fairless.

#1 Invest for cashflow. Cashflow has always been the backbone of real estate’s economic resilience.

#2 Leverage with long term fixed rate debt. In a shifting environment with the potential of rents and revenue decline, fixed rate debt removes a large variable expense from the business, making it easier for investors to preserve capital and ride out the storm of an economic contraction.

#3 Have adequate cash reserves. It is very important to have enough cash reserves to cover unexpected expenses, and cover possible shortfalls caused by temporary declining rents.

I do believe that declining property prices will lead to some great investing opportunities in 2023, but for those who have only known investing in a bull market, I recommend careful planning and exercising caution.