The mantra of 2024 has been “Stay alive until ’25”. However as we assess the reality of 2025, we are forced to take a closer look at the market environment and ask “What has really changed since last year?”

While interest rates at the Fed have come down, Treasury markets remain volatile, and commercial mortgage debt remains expensive. Markets that once had robust rent growth fueled by outsized demand pressure have seen demand tempered, by vast amounts of new deliveries that have tippeed many markets into oversupply and recession.

While property foreclosures, and tough market conditions have forced property values down 20-35% across most markets, it’s tough to put these discounts into context when concessions and negative rent growth make for questionable near-term growth.

Add to this the looming threat of global recession, and it is a very confusing time for investors to figure out what’s next, and how to best to allocate capital.

If you just want the answer here it is.

Buy every deal that cashflows. Buy quality, late-model product, in good markets. Don’t over leverage and be aware of your prepayment penalties. Rates will come down; the new supply will get absorbed. Demand for rental housing will increase, driving rent growth. And demand for multifamily investments will increase, driving investment returns.

If you want to know why this is the answer keep reading.

Investing in Multifamily is fundamentally two component investments. First an investment in the underlying rental housing business. This investment is driven by the local housing market, as well as the local economy. This business generates cashflow, and will generate more or less cashflow in the future depending on shifts in supply, and demand happening at the local level.

The second investment is an investment in how much the cashflow is worth relative to other investments, based on the risk profile.

Underlying real estate performance

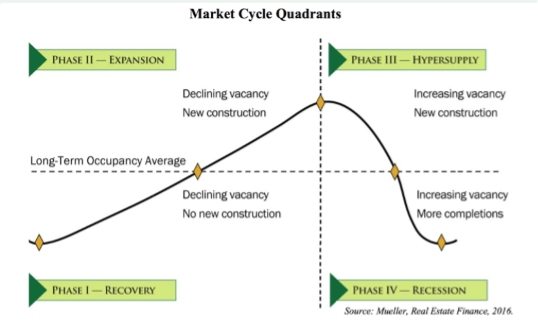

This investment in the underlying rental business is driven by the real estate cycle. Normally the hyper local nature of the real estate cycle causes real estate investments to be somewhat decoupled from the broader investment market. However, the unique circumstances created by the Covid pandemic caused a sudden increase in housing demand driven by work from home migration, and then a sudden increase in supply which was facilitated by the low-interest rate environment that was meant to stimulate the Covid lock down economy.

This rapidly increased supply has brought many markets into the hyper supply phase of the real estate cycle.

Normally each markets cycle is driven independently by local employment, populations growth, and housing development. However these unique circumstances have forced market cycles to not only sync-up with each other, but they are also syncing with the larger macroeconomic cycle, which has created a real estate super cycle low, in which property values are currently trading at significant discounts.

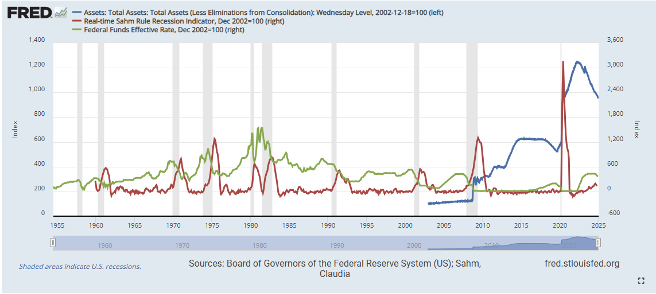

Additionally, the broader economic cycle has the global economy moving into recession, and the investment world is slowly shifting into risk-off assets.

As the economy moves further into recession, central banks will continue to cut benchmark rates, and move into asset purchases to stimulate economic growth, and employment. This will be one of the catalysts that will cause real estate values to come back up.

The lower cost of capital will allow investors to make higher yield with less capital, and the risk profile of real estate will begin to become attractive again, when viewed against the investment alternatives available in the recession market.

Once rates drop and the attractive risk-free yield of bonds, and money market funds begins to drop, investors will be looking to move cash into stable and safe alternatives, and historically real estate has been one of these assets.

As more liquidity flows back into real estate, the value of real estate assets will continue to increase, boosting investment returns for those owners who managed to hold on to their real estate through 2023-2024, or managed to make good purchases through 2025.

So where is the bottom?

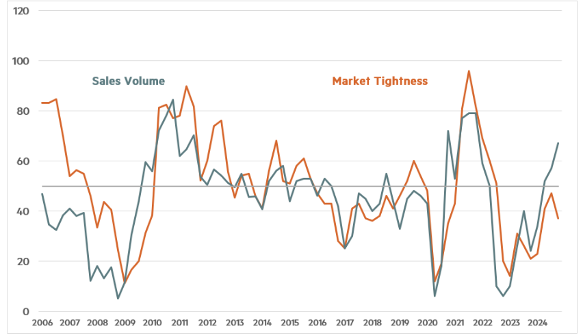

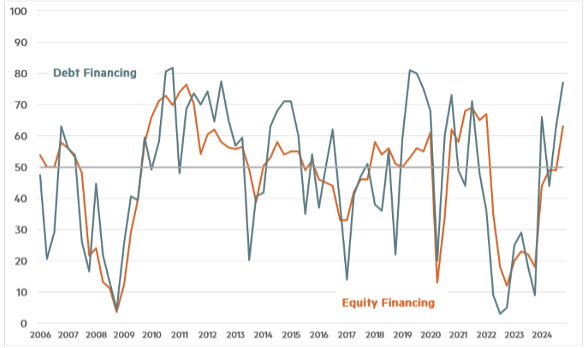

No one can know exactly where the bottom of any market is, but I can tell you we are probably closer than you think. Judging by the market tightness, the sales index, and the financing indices, real estate is getting much closer to heating up again. As of Q4 2024 the sales volume, equity financing, and debt financing index where all trending up and above the 50 benchmark indicating a return to a bull market.

However, the market tightness index retreated from 47 to 37 in tat period and dropped below the 50 benchmark. Market tightness is a measure of the ratio of buyers and sellers transacting in the market. A tight market has a lot of buyers with few sellers, and a loose market has lots of sellers and no buyers.

Given the environment of 2024, it makes sense that buyers participating in the market are limited despite increased sales volume and availability of debt and equity financing.

Most investors are still waiting for the right time to jump back in. This brings to mind the famous quote from Warrren Buffet “Be greedy when others are fearful, and fearful when others are greedy.”

Taking a look at the fundamentals of the market we can say a few things with certainty:

- Property prices are cheaper

- Financing is available albeit expensive

- The future supply pipeline is tapering with an expected 500k deliveries in 2025 and 371K in 2026

- Recent deliveries are being absorbed, as Q3 2024 posted the second highest net absorption

- Sales volume is increasing, but sellers still outnumber buyers, which means for now sales prices will remain low.

The global economy is headed into recession, and recession will bring more stimulus from central banks, and more stimulative fiscal policy from congress.

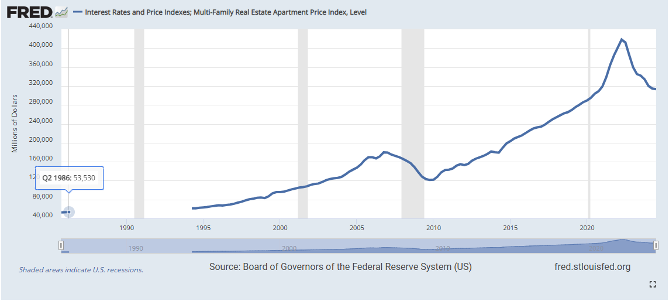

The multifamily price index as of Q3 2024 is down over 25% from the 2022 peak. This is nearing levels of the 32% price correction seen in the 2008 GFC.

It has been a rough couple years for multifamily investors in the wake to the Covid black swan, but 2025 is shaping up for the battered asset class to take revenge, and showcase its innate recession resistance, and once again provide investors with stable yield and long term growth.

To learn more about how we can help you to generate superior investment results through professionally managed Real Estate investments, click here to register for our investor club.