Some syndicators will be waving banners this week shouting out that 100% bonus depreciation is back. It’s true, that if the Senate passes Trump’s “big beautiful bill”, bonus depreciation will be back and that may be a boon for Limited Partner investors and the capital raisers who seek to attract them.

However the broader macroeconomic outlook from the Bill paints a much more pessimistic story for real estate.

Yes, the Bill makes tax cuts permanent, and includes bonus depreciation provisions, which real estate investors hope will spur demand. However, the bill is projected to add 3 to 5 trillion to the national debt over the next 10 years and this brings with it other problems.

Demand for US Bonds is down

On Wednesday 21st May, the Treasury department sold $16B of newly issued 20 year bonds and saw weak demand for these bonds. There were not enough buyers, as bond investors postulated that if the spending bill passes, the US deficit will continue to increase to unsustainable levels that will run up debt further over time. As a result, yield curves pushed higher, as investors demanded a higher risk premium reflective of the increased debt that the US is projected to take on over time.

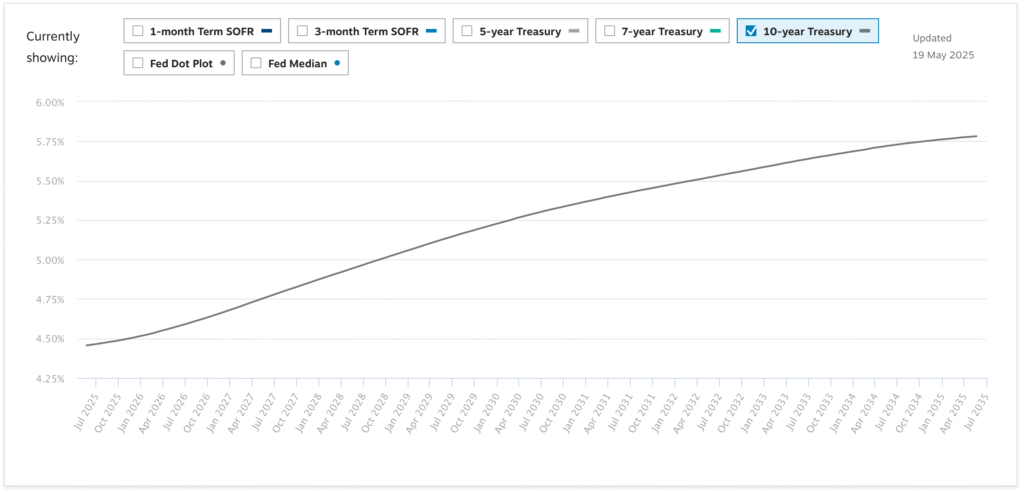

This highlights the broader challenge – that interest rates are showing no signs of reducing. Even if the Fed starts reducing the funds rate, that only impacts the short end of the curve. And as long as bond investors are negative on the US, long term interest rates could remain elevated. It is the long end of the curve that typically has the biggest direct impact on the cost of debt for multifamily real estate investments.

Interest rate projections remain elevated

As of writing this article, polymarket.com shows only a 6% chance that the Fed will cut rates in June, a 19% chance in July and a 29% chance in September. Early projections that the Fed would cut rates multiple times in 2025 have been scaled back and there is a real possibility that the Fed Rate won’t be reduced at all in 2025.

Chatham Financial shows forward 10-year treasuries forecast to increase over time. Rates are projected to remain elevated and even exceed 5% by 2028 and start to approach 6% in the long term.

The expectation is now that rates will stay higher for even longer and this has significant consequences for the cost of debt and the ability for refinances.

Impacts on Real Estate

Those that have been trying to “survive to ‘25” and planning on refinances to save their investments are going to struggle. This should create more opportunity for buyers, although we are seeing many of these distressed deals being traded quietly behind closed doors and they do not tend to be marketed broadly.

In theory, if sellers accept that the cost of debt is likely to remain higher for longer, they should be willing to reset their pricing expectations and lower their asking prices in order to make a trade possible. Perhaps we will see more of this, as we head towards the end of 2025.

One of the biggest challenges with underwriting remains the volatility of interest rates. Not only do interest rates remain high (by recent standards), they have been fluctuating significantly over the last 18 months, and this makes it incredibly difficult to form assumptions about the cost of debt when underwriting an acquisition. There have been multiple 5-day periods in the last few months where the interest rate on 10-year Treasuries has fluctuated more than 50 basis points, both upwards and downwards. Not only does this have a material impact on the amount of debt proceeds that coud be available, but on a $20M loan, that can add more than $100k per year in debt service costs, which can be the difference between a deal that works and a deal that does not.

Conclusion

There remain a number of significant challenges in getting the “big, beautiful bil” through the Senate, as many Republicans are looking for the Government to start to take meaningful action to reduce the deficit and the national debt over time. Whatever happens, it is clear that many investors are concerned about the ability of the US to meet its long term obligations and this is continuing to create volatility and put upward pressure on interest rates.

Leverage and interest rate risk continue to be key risks for real estate investors and these will need to be managed even more carefully as we continue on an uncertain path over the next few years.

The silver lining is that buying opportunities are emerging. Stressed deals will become distressed over the next few months, and as long as real estate investors can prudently manage leverage and interest rate risk, really good deals may become available.

To learn more about how we can help you to generate superior investment results through professionally managed Real Estate investments, click here to register for our investor club.