The Federal Reserve’s aggressive interest rate hikes to combat inflation have caused significant stress on the economy, investment, and credit markets. Recently, the collapse of several banks, including SVB, Signature Bank, and Credit Suisse, has highlighted the fragility of the fractional reserve banking system. It raises questions about whether the Fed has reached the “terminal rate” at which point inflation will decline without further rate increases.

What does the market say?

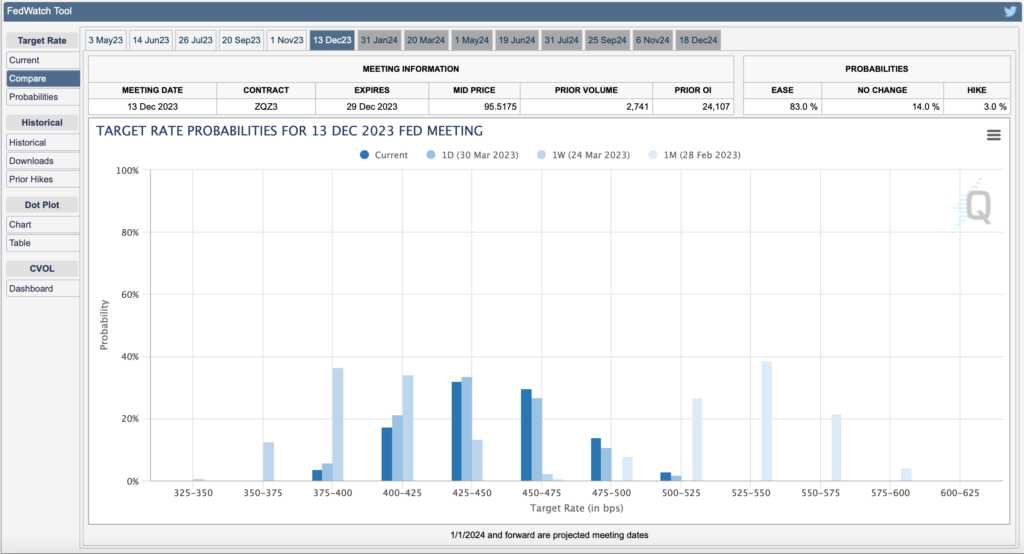

The market’s view on this has significantly shifted in the last month, and this is shown in the exhibit below which clearly shows that expectations for the fed funds rate at year-end have reduced from circa 5-6% (as at 28 Feb) to circa 4-5% (as at 30 Mar). The market is clearly now expecting some Fed rate reductions before year-end.

The markets have a tendency to overreact in both directions when news shifts, so we will need to wait and see if the current market view proves correct.

What are the impacts on Commercial Real Estate?

The commercial real estate industry has been impacted significantly by the Fed’s rate increases. Many properties with variable rate debt have seen their debt service costs skyrocket, pushing some deals into negative cashflow.

The rate hikes have also reduced the leverage and debt available to investors, making it challenging to refinance into fixed rate debt. This lower leverage environment has reduced the value of properties, with cap rates in many markets expanding 50-75bps over the last few months.

Although rents in some markets still continue to grow, this growth has not kept up with the expansion of cap rates or the increase in debt service cost, which is making it hard for some investors to hang on and ride this out.

Given that the end of the tightening cycle may be in site. Those owing deals with low prepay penalties may be the only ones selling in a low inventory environment, and although real estate has taken a beating recently, there is a strong case to be made that the large amounts of capital waiting to rush back into the market may put pressure on cap rates and prop up real estate values as we progress through 2023.

What about the broader economic impacts?

A big question is how quickly the economy will recover from a recession, and whether rents will hold up after the historic rent growth of the post-pandemic era. In the near future, it may be the well-located, quality value-add projects that benefit from the economic transition. Investors should steer clear of low-income demographics and focus on areas with higher income to rent ratios and quality demographics.

There may be a window of opportunity to purchase great deals at a very attractive basis before the dry powder rushes back into the market. This may also present an opportunity to sell existing deals as investors with capital compete for the limited inventory of commercial property for sale.

While real estate transactions are generally slow, times of transition and volatility can provide opportunities to pick up good deals at a discount, with less competition from investors currently on the sidelines.